Trends come and go, never fleeting faster than when a crisis rears its head. App stores represent one of the most rapidly changing areas in the consumer market. The old “fifteen minutes of fame” quib from Andy Warhol applies well in this scenario. Some apps last years, while others only last months or weeks—it’s inevitable that users will want something new. The main challenge plaguing app marketers face is the inability to amend their campaigns when the winds of change shift.

Just like our digital world around us is always in flux, so are our app stores, designed to shift with the interests of the users and to protect their interests. Rules and algorithms change constantly to ensure fraud is minimized-by deleting fake reviews or warning users before deleting apps for which they’re still paying subscriptions. App store optimization (ASO) regulations have also changed to prevent app marketers from filling app store descriptions with relevant keywords incoherently. Beyond the preventative measures, they also change by country depending on social, political, and economic situations.

App marketers must be aware, however, of the statistical likelihood that users will keep using their apps. Apps that don’t have a lot of value don’t have a long lifespan, because users move on quickly, and most apps don’t have long-term value to users. This varies by the types of app and its long-term relevance. Messaging apps tend to have higher retention rates, which makes sense because communication is an ongoing essential need, whereas gaming apps can have shorter lifespans because they are recreational and non-essential—dispensable in nature. Localytics found that after three months, an average app’s rate of continued use after the first time is about 29 percent. In general, app retention rates are about 5 percent. This has been the trend for the last decade. On average, since 2012, the average rate for apps being used more than once has stood around 30-40 percent, according to Statista data.

COVID-19 changed the narrative quite a bit in the app store and rapidly, too. While the same sort of guiding principles in marketing the apps, like ASO, didn’t change dramatically, the focus of users did. For starters, as users around the globe found themselves at home, app installs and time spent using apps rose 20 percent. According to Visual Capitalist analysis, delivery and social media apps experienced an enormous rise in use, but not necessarily any significant increase in downloads. Media and entertainment, healthcare, online shopping, and communication apps saw both an increase and installs and users. For example, between February and April 2020, Instacart experienced a 650 percent rise in new users, while gaming apps saw an increase in 75 percent between March 12 and 19. As could be anticipated, video conferencing apps for business skyrocketed in downloads, nearly tripling in weekly downloads from October 2019 to April 2020.

These kinds of user behavior patterns in the app store are expected, but others are a little more noteworthy. Sensor Tower reported a 24 percent increase in mental-health app store downloads in April, a statistic that isn’t surprising given the mobility restrictions of the lockdown, but one that is less likely to catch the attention of marketers. Unique and anticipated behavior patterns in the app store tended to follow the geographic transition of the coronavirus. Areas the virus hit earlier, such as the European continent, saw the aforementioned trends in the app stores. Others that were yet to be hit hard saw their app stores’ activity remain largely in a pre-COVID state until the virus actually struck. These trends, both in their geographic transitions and their content, can tell app marketers much about the next few months, considering the anticipation of a resurgence in most countries.

The key in gauging the trends and reacting accordingly is to be able to pivot quickly, whether from campaigns of conversions, downloads, or encouraging retention/more usership. Directing a budget into one basket can have dangerous results, because as soon as the epicenter changes or data shows a change in user attitudes, budgets can go to waste. In an unpredictable world that is the COVID-19 pandemic, most app marketers will have to be flexible. The opposite doesn’t ring any truer, though, by speculating too much. A vision for what’s coming is critical and seeing already where the pandemic is moving and where it’s moving away from is a start.

New Zealand, for example, revealed recently it had reached zero cases, while in South America COVID-19 is hitting hard. And the app stores are reflecting the presence of the virus. In New Zealand, AppAnnie analytics showed that on April 1-during the peak of the pandemic curve worldwide-in the Apple Store, the top five apps downloaded were Zoom, Houseparty, TikTok, Microsoft Team, and Disney. As of the end of June, where the number of cases dropped below 50, the top apps data changed to predominantly games, while Tinder moved up from fourth highest-grossing to second, and SkySports resurfaced amid talk about sports returning.

South America’s ap stores show signs of a continent struggling to contain the virus. Brazil, a country with a large Android majority and one that has eased restrictions while deaths are peaking, has witnessed Tinder drop in the top-grossing category but also has seen the messenger and social apps drop off significantly from the top five Android app store list. Peru, a country that experienced a later explosion of cases, saw an app store drive to communications apps by late June when the pandemic started to wreak havoc, with social media and communications apps topping the charts.

Another trend that could determine the future of the app store while COVID-19 continues to grip the planet are the changes in the direction of the virus’s mutation. The Telegraph reported on June 20 that an Italian infectious disease clinic chief believes its virulence has died as it has mutated. This could signal that in some areas, as the public opens, app store trends could return to pre-COVID status.

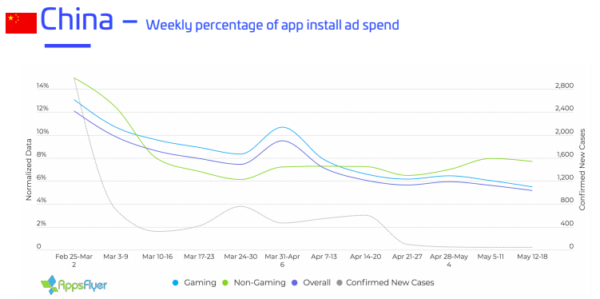

Given these types of quick pivots in the app store, app marketers will also shift budgets accordingly. Appsflyer data shows the correlation between the number of new cases per day and the app store budgets, especially in China. Moving forward marketers will also shift their budgets to continents and regions that experience a jump in app usage and specific types of apps that meet the needs of their COVID-19 situations.

- Appsflyer data shows the correlation between the number of new cases per day and the app store budgets, especially in China.

Regardless of what the pandemic has in store next for humanity, app marketers across the spectrum must be prepared to manage the quick change. A jump in cases in one area can inculcate marketers with a feeling that an opportunity exists elsewhere. The key is to always be on a swivel, because during these challenging times, the tide turns quickly.

_____________

The article was first published on Business 2 Community on July 23rd, 2020